Since the last poultry industry outlook published in December 2024, new factors have influenced the sector due to recent global political events, national fiscal changes, and global market disruptions caused by disease outbreaks.

In the recent South African budget review, the proposed expansion of the value added tax (VAT) zero-rated basket of food items, which included poultry, was scrapped.

The decision to scrap a VAT increase and the zero-rated basket expansion was made to avoid the political backlash associated with the initially proposed VAT hike.

Instead of increasing VAT, the government is implementing other tax adjustments, such as fiscal drag, increased excise duties, and fuel levies.

The National Agricultural Marketing Council (NAMC) has indicated that the rise in the general fuel levy is likely to result in adverse economic implications for the agriculture sector.

Fuel accounts for roughly 13% of variable input costs in primary production and agri-logistics, especially given the industry’s reliance on road transport and scattered operations.

Rising fuel costs are expected to make food more expensive and harder for low-income households to afford.

To help, the NAMC suggests improved access to diesel rebates for small farmers, investment in rural transport and alternative energy, and deeper research into fuel-efficient farming methods.

Brazil’s First Bird Flu Outbreak

On 15 May, Brazil’s confirmed the presence of highly pathogenic avian influenza (HPAI) in a commercial poultry farm in Montenegro, Rio Grande do Sul.

South Africa’s Department of Agriculture, Land Reform and Rural Development (DALRRD) placed an immediate blanket ban as a standard bio-security protocol when a regionalisation agreement is not in place. Brazilian import bans were backdated to poultry products packed on or after 01 May 2025.

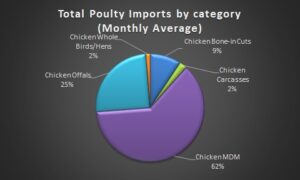

Brazil accounts for 92% of the country’s mechanically de-boned meat (MDM), importing an average of 18,000 metric tonnes per month. It also supplies 73% of other poultry imports, including chicken offals and bone-in chicken.

Total Poultry Imports by Category: Jan-May 2025

After a two-month halt in poultry trade, DALRRD officially reopened import permits for poultry from Brazil on 4 July 2025.

While DALRRD had announced a regionalised protocol for Brazil on 19 June, no regionalisation agreement was settled on between South Africa and Brazil and therefore no trading took place.

Brazil was officially declared free of avian influenza as of 26 June, and the market was re-opened by DALRRD a week later.

There is still no regionalisation agreement in place between South Africa and Brazil.

Market Impact

The ban, which halted nearly all shipments overnight, has resulted in significant losses:

- An estimated 100 million meals per week were compromised during the suspension, particularly impacting school feeding programmes and low-income households.

- Meat manufacturers experienced layoffs after factories were unable to import MDM for two months.

- MDM prices spiked by 140%, driving up inflation for budget chicken products

Ongoing Impacts

Even with the ban lifted, it will take 6–8 weeks to replenish supply chains due to shipping and customs delays.

Prices for processed meats are expected to remain high until October, with regular supply and pricing only expected to stabilise by November 2025.

Policy Implications

Industry leaders are pushing for policy certainty and regionalisation protocols which are crucial to mitigating the risk of future food crises.

This would allow imports from unaffected regions during disease outbreaks, as is already practiced with the USA.

Export Opportunities: Still Promising, but Conditional

- The EU, UK, and Saudi Arabia remain key targets for South African poultry exports, particularly cooked breast meat. However, due to phyto-sanitary restrictions uncooked chicken exports are not anticipated at this stage.

- Inspections by the UK and Saudi Arabia are underway, and residue monitoring programmes have been submitted — a necessary step toward market access.

- Chicken exports rose by 4% year-on-year, totalling 58,045 tonnes, with bone-in chicken still leading the export category.

South Africa’s Chicken Exports 2021-2024

Avian Influenza: New Outbreaks & First Vaccination Rollout

New H5N1 outbreaks were confirmed in Mpumalanga and North West provinces in July 2025. Over 100,000 birds were culled, and the industry is on high alert again.

In a major shift, South Africa issued its first-ever permit for HPAI vaccinations to Astral Foods on 30 June 2025, marking a proactive step toward disease management. The vaccine targets the H5 strain, but H7 vaccines are still under development, which limits full-spectrum protection.

Regionalisation & Compartmentalisation: Still the Goal

These strategies are still viewed as essential for sustainable exports and disease containment, but implementation remains slow and requires bilateral agreements with trading partners.

Poultry: South Africa’s Sectoral Divide

Amid the Brazil blanket ban, South Africa’s industry leaders called for urgent regionalisation measures to secure supply of the country’s primary poultry import; MDM, to safeguard food security and jobs.

At the same time, local producers assured the public that there was no risk of poultry shortages, aside from MDM, fuelling a rather polarised narrative during the closure of Brazil’s imports.

There are public misconceptions surrounding chicken imports and their perceived threat to local production and employment in South Africa.

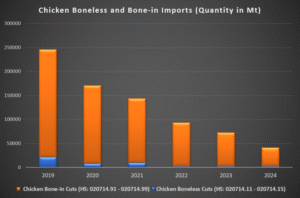

Historically, there have been instances where local producers had legitimate claims to unfair pricing and issues of chicken dumping. Since the introduction of anti-dumping tariffs, this risk has been mitigated, and poultry imports have seen a sharp cut.

Looking at the latest trade statistics, imports of bone-in portions dropped by 83% from 224,198 tonnes in 2019 to 38,956 tonnes in 2024.

Decline of Poultry Imports 2019-2024

In practice, both domestic poultry production and poultry imports play vital roles within South Africa’s poultry value chain. The meat processing industry sustains approximately 125,000 jobs, while the agricultural poultry sector directly employs around 50,000 people.

However, statistics show that South Africa does not produce enough chicken for domestic consumption. Imported poultry continues to bridge a 20% supply gap that domestic producers cannot fill.

Notably, MDM is not commercially produced within South Africa, and local output of chicken offals remains insufficient to meet national demand.

MDM is used to produce processed meats including polony, viennas, and russians. This exclusively imported chicken product is crucial to the meat manufacturing sector and lower income consumers.

Imports have repeatedly been linked to domestic production challenges, yet structural factors within the industry remain the primary constraints on growth.

Industry experts suggest that South African poultry producers could boost resilience and profits by focusing on higher-margin, value-added products like deboned chicken breasts, ready-made meals, and canned chicken, rather than relying low-margin Individually Quick Frozen (IQF) chicken.

Additional challenges include trade barriers and strict sanitary and phytosanitary regulations imposed by markets like the EU and US, which hinder export opportunities. South Africa’s higher levels of brining in chicken products further reduce its competitive edge in international markets.

Addressing these issues could improve export opportunities, ease tensions over anti-dumping duties, and promote a more favourable trade environment through better diplomacy and predictable policies.

See related: World Economic Forum’s Strategic Brief on Misconceptions around Trade Balances

Trade Statistics (Figures ending March 2025)

| METRIC | STATUS |

| Chicken exports | ↑ 4% YoY (to 58,045 tonnes) |

| SA-origin exports | ↓ 6.25% YoY |

| Imports (bone-in) | ↓ 44% YoY |

| Imports (MDM & offal) | ↑ 6–9% YoY |

Source: SARS trade statistics

Conclusion

Despite ongoing volatility, South Africa’s poultry industry is navigating 2025 with cautious resilience.

The sector remains under pressure from rising fuel costs, constrained domestic production, and the lingering effects of Brazil’s bird flu-related import ban, which disrupted MDM supply and inflated prices for processed meats.

While the government’s reversal of VAT basket expansion has removed a potential affordability lever, industry stakeholders are advocating for regionalisation protocols and policy certainty to safeguard trade and food security.

Encouragingly, export opportunities are taking shape, with inspections underway in key markets, and the rollout of HPAI vaccinations marks a proactive shift in disease management.

However, structural pressures between domestic production and imports persist, underscoring the need for strategic reform towards inclusive growth for the whole value chain, working towards food security.

Crises force innovation and change. The prevalence of animal disease is a material risk to food security, and one strategy to mitigate this risk is proactive policies like bilateral trade, multiple trade partners, and agile trade policies.

For the remainder of 2025, the outlook hinges on stabilising supply chains and staving off the local threat of bird flu outbreaks.

In the long term, strategic shifts towards advancing bilateral trade agreements, driving lower production costs, and a focus on value-added poultry products are key to strengthening South Africa’s poultry sector.