The South African poultry industry has criticised Government’s Tariff Rate Quota (TRQ) Agreement with the United States, claiming that the domestic poultry sector is being “sacrificed” to the 72,000-tonne annual quota allocated for U.S. chicken imports.

ChickenFacts examines the TRQ, outlining details surrounding its implementation and the real-time effects on both the poultry sector and consumers in South Africa.

Read: A Closer Look at USA’s Self-Imposed Poultry Trade Restrictions with South Africa

Sacrifice?

To put this in perspective, South Africa consumed an estimated 2.2 million tonnes of poultry in 2024. Approximately 1.96 million tonnes of which were produced locally.

According to SARS trade statistics, South Africa imported 398,000 tonnes of chicken, of which 239,000 tonnes was mechanically deboned meat (MDM), which is not produced locally.

- 85% of total consumption was met by domestic production.

- The remaining 15% came from imports.

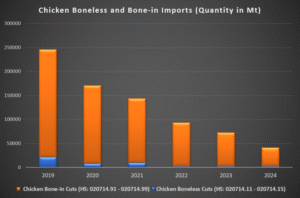

- Bone-in chicken imports for 2024, totalling 38,953 tonnes, account for 1.8% of South Africa’s overall chicken consumption.

The level of concern lamented by local producers in respect of the TRQ seems disproportionate, considering the 72,000t quota represents 3.1% of SA’s total annual chicken consumption.

In 2024, the US exported 11,351 tonnes of bone-in chicken to South Africa, making up only 16% of the current quota.

Moreover, imports of bone-in chicken cuts have consistently declined over the past 5 years due to trade restrictions and anti-dumping duties.

The 62% duty imposed on U.S. chicken has been particularly prohibitive, effectively depriving South African consumers of a more affordable source of protein.

Meanwhile, the USA’s poultry industry has been subject to ongoing bird flu outbreaks over the last two years. As a result, very little poultry has entered South Africa from the U.S despite the annual quota.

It is important to recognise that avian influenza is not confined to the United States; it has developed into a worldwide epidemic impacting poultry-producing nations including China, Argentina, and South Africa.

South Africa imports chicken to cover a 15% gap in domestic consumption, as local production falls short of demand and food security depends on these imports. Therefore, it is essential for South Africa to develop adaptable trade policies that facilitate secure access to international poultry markets.

Key Conditions of the Tariff Rate Quota (TRQ) Agreement

- Year established: 2016

- Quota Volume: Originally set at 65,000 tonnes, the quota was expanded to 72,000 tonnes by 2025. This is based on production vs consumption showing growth in the market over the last 10 years as published by DALRRD.

- Product Scope: Applies specifically to frozen bone-in chicken portions (e.g., thighs, leg quarters, drumsticks).

- Anti-Dumping Duty Rebate: Imports under this quota are exempt from the 9.40/kg anti-dumping duty normally applied to U.S. bone-in chicken.

- General Tariff: Even with the quota, U.S. poultry still faces a 62% general tariff.

- Utilisation Rates: Only 58% of the quota was used in 2022/2023 due to high tariffs, structural challenges, and poor market conditions.

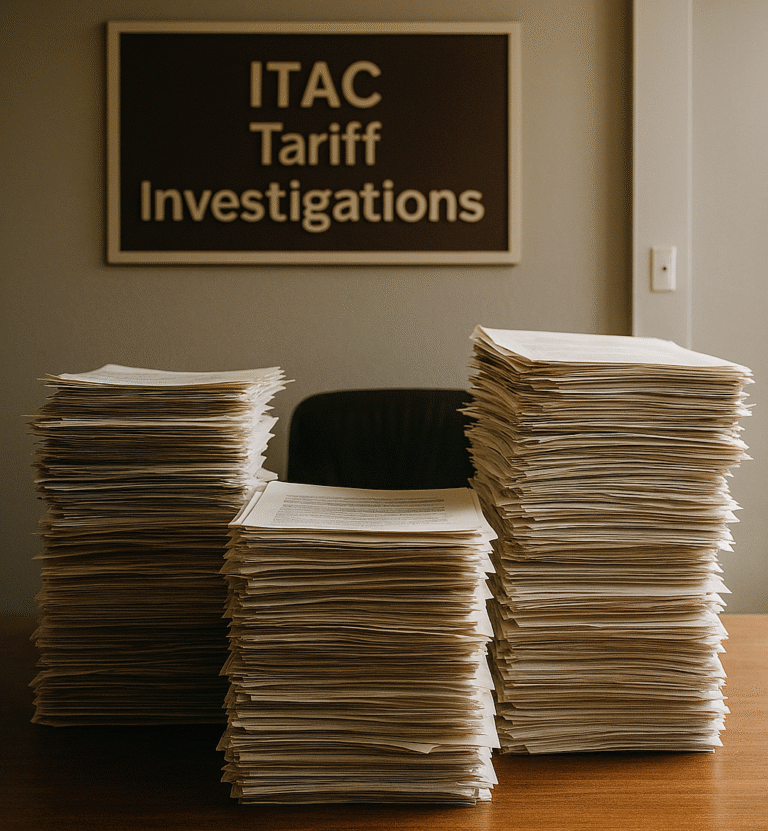

Stalled: Poultry Tariffs Review

In March 2020, ITAC implemented Most Favoured Nation (MFN) customs duties on imported poultry to protect local producers. These duties are applicable to chicken imports from all countries except the EU, the UK and SADC nations:

- Frozen bone-in portions: 62%

- Whole frozen chicken: 82%

- Frozen boneless portions: 42%

- Frozen carcasses: 31%

- Frozen offal (heads, livers, feet): 30%

While local poultry production is an imperative, the level of protectionism that has been afforded to local producers has placed poultry imports under major duress for the last five years.

Local producers have enjoyed market monopoly of bone-in chicken since the introduction of the MFN duties in 2020, which have essentially wiped-out competitive chicken imports.

In March 2021, Minister Ebrahim Patel directed ITAC to review the poultry tariffs. This review was meant to:

- Assess the combined impact of tariffs, anti-dumping duties, and trade agreements.

- Simplify tariff lines (e.g., shift from 8-digit to 6-digit codes).

- Consider rebates or import licenses for compliant importers.

- Potentially reduce ad valorem tariffs depending on progress made.

The application was lodged by the DTIC, however no poultry tariff investigation report has been published by ITAC to date.

Donald MacKay, Director of XA Global Trade Advisors, told ChickenFacts that this practice is not uncommon for ITAC. “ITAC typically includes a statement at the end of reports recommending a review after three years following increased duties. In practice, such reviews rarely occur. As a result, these tariffs tend to remain unchanged.”

MacKay further explained that the current tariffs inflate the cost of chicken to consumers. “The problem is that what you should be using a tariff for is to give protection for a period while the sector gets onto its feet. This is simply evergreen protection. So, the consumer will always end up paying more.”

Reflecting on why the local industry has not boosted production or export markets, MacKay noted that high levels of protection reduce motivation: “With the extremely high duties on chicken, there’s little incentive to innovate. Investing in maintaining or increasing protection often seems more attractive than striving for competitiveness. I think that’s the situation we see in the domestic chicken industry,” MacKay concluded.