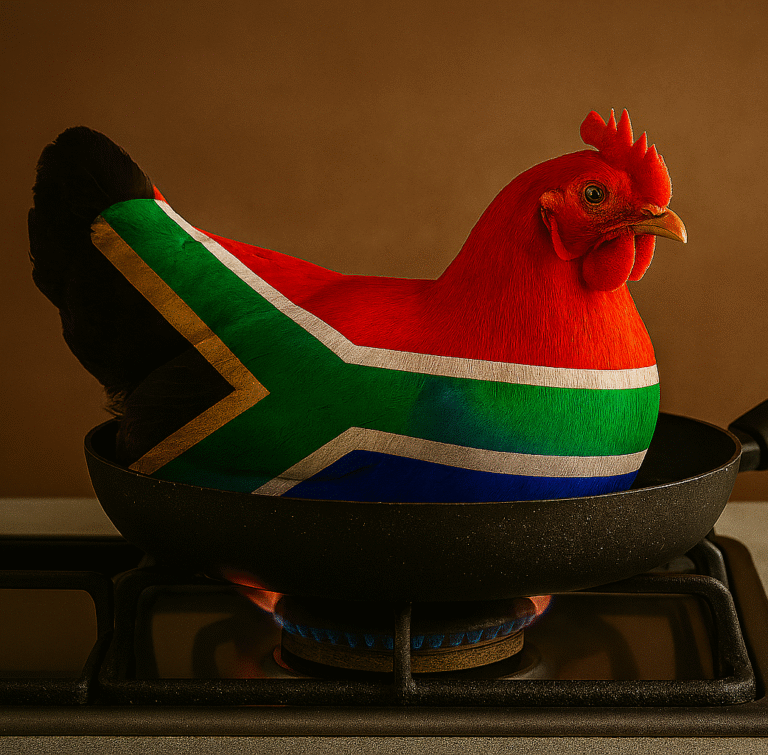

South Africa’s poultry industry is at the centre of trade disputes after reports of US chicken shipments headed to the country, sparking new accusations of “dumping.”

The South African Poultry Association (SAPA) has raised concerns that US exporters are flooding the local market with cheap bone-in portions, undermining domestic producers.

However, a closer look at the data and trade protocols reveals a different story that points to tariffs, not dumping, as the real issue.

What Is Dumping—and Is It Happening?

Dumping occurs when a country exports goods at prices below their normal value, often undercutting local producers. But in the case of US poultry exports to South Africa, the evidence simply doesn’t support this claim.

Imports under Tariff Rate Quota (TRQ) Agreement, are exempt from the 9.40/kg anti-dumping duty normally applied to U.S. bone-in chicken. Even with the quota, U.S. poultry still faces a 62% general tariff.

According to the USA Poultry & Egg Export Council (USAPEEC), US exporters have consistently underutilised their 72,000-tonne quota.

In 2023, only 44,421 tonnes were shipped. In 2024, that figure dropped to 12,909 tonnes. For the first half of 2025, just 2,005 tonnes were exported.

“If dumping were the goal, the quota would be fully used, or exceeded,” says USAPEEC spokesperson.

The sharp decline in exports is not due to market saturation or aggressive pricing. It stems from two key factors: the 2022 outbreak of Highly Pathogenic Avian Influenza (HPAI) in the US, and South Africa’s decision to raise its Most Favoured Nation (MFN) duty on bone-in portions from 37% to 62%.

USAPEEC explains that these developments have made US poultry less competitive, not more.

The Role of Tariffs: A Hidden Cost to Consumers

While SAPA frames the issue as one of unfair competition, USAPEEC argues that the real barrier is the steep tariff increase.

The 62% duty acts as a regressive tax, disproportionately affecting low-income South African households that rely on chicken as an affordable source of protein.

Far from flooding the market, US exporters are struggling to maintain a foothold. The tariff has priced US chicken out of reach for many importers, leading to a dramatic drop in volumes. This not only limits consumer choice but also stifles innovation and competition in the sector.

HPAI Protocols: Science-Based, Not Political

Another point of contention is the USA’s self-imposed restrictions protocol used to manage avian flu risks.

SAPA has suggested that this system poses a risk to local chicken flocks, allowing the US to resume exports without South African oversight. But this characterisation is misleading on the nature of the agreement.

“The protocol is not a political concession, but a standard, science-based approach already used by most of the US’s trading partners,” USAPEEC explains.

With these measures, countries can reopen markets sooner and minimise supply chain disruptions.

It allows for swift containment and recovery, based on transparent reporting and rigorous biosecurity measures.

USAPEEC notes that the system is backed by the US Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) and the National Poultry Improvement Plan (NPIP), both of which enforce strict farm-level controls.

Only 14% of U.S. production is exported, and thus U.S. consumers are eating the same product that is exported. Therefore, the U.S. maintains high levels of biosecurity at all levels.

Food Safety: A Robust Framework

Concerns about the safety of imported poultry are also addressed by USAPEEC, which outlines a multi-layered food safety system that includes:

- Continuous federal inspection under the USDA’s Food Safety and Inspection Service (FSIS).

- Mandatory Hazard Analysis and Critical Control Points (HACCP) plans for all processors.

- Rigorous pathogen testing for Salmonella and Campylobacter.

- Consumer education campaigns promoting safe handling and cooking practices.

These measures ensure that US poultry meets high safety standards before reaching international markets. The implication that US chicken is unsafe or inferior is not supported by the evidence.

Trade-offs and Misinformation

SAPA has suggested that the poultry sector is being “sacrificed” in favour of other agricultural interests, such as blueberries and citrus.

USAPEEC strongly disputes this claim, calling it misleading and divisive. “The US-South Africa poultry agreement is the result of almost 2 years of negotiation, grounded in mutual benefit and scientific rigour. It is not a zero-sum game and portraying it as such risks undermining broader agricultural cooperation.”

“The US poultry industry recognises that this is a comprehensive negotiation and that a fair and balanced outcome is in the best interest of both nations,” USAPEEC concluded.

The Bigger Picture: Affordability, Access, and Trust

At its core, this debate is about access to affordable, safe food. South African consumers deserve transparency and choice. Tariffs that protect domestic producers at the expense of affordability do not serve the public interest.

USAPEEC’s position is clear: the US is not dumping chicken in South Africa. Export volumes are down, not up. The quota is underutilised. The HPAI protocol is standard practice. And the 62% general poultry duty is the real barrier to trade.

As ChickenFacts continues to advocate for evidence-based policy and consumer education, we urge stakeholders to look beyond rhetoric and examine the data. Trade should be fair, but it should also be informed.